Hyatt Hotels, based in Chicago, Illinois is one of the leading global luxury hotel chains in the world, with almost $4.68B of revenue and over 45,000 employees globally as of 2017. Hyatt has a long history of acquisitions that have driven continuous growth since the first Hyatt House opened in 1954 at Los Angeles airport, but remains only a strong #3 in the industry behind Marriott Corporation and Hilton Worldwide.

As Hyatt aims to close the gap and overtake these two giants, their strategy for most of 2017 and 2018 has focused on acquisitions and re-branding as the leaders in wellness. This would align with cultural trends and relevance to the millennial generation as they grow into high frequency business traveling ages.

In 2017, Hyatt drove this strategy by acquiring Miraval group, a wellness resort and spa brand, and Exhale, a spa and fitness brand with locations in the US and Caribbean. Mark Hoplamazian, Hyatt president & CEO stated “As a company, we are focused on the high-end traveler” and strive to capitalize on “playing into the growing "bleisure" trend, a mashup of business and leisure travel”.

“More and more people today want to continue the routine they've established at home on the road” says Annbeth Eschbach, Exhale CEO, “and so it is not as much a demographic as it is for psychographic.”

After visiting Miraval Arizona, Hyatt’s Hoplamazian was “enamored by the brand and the experience after participating in a floating meditation class” and knew these would be the right two kind of brands to bring to Hyatt to expand their wellness portfolio. But what do Hyatt’s existing most loyal fans think about wellness, and how do they compare to a broader audience of high-end travel and wellness enthusiasts? We decided to compare several different audiences to evaluate this strategy.

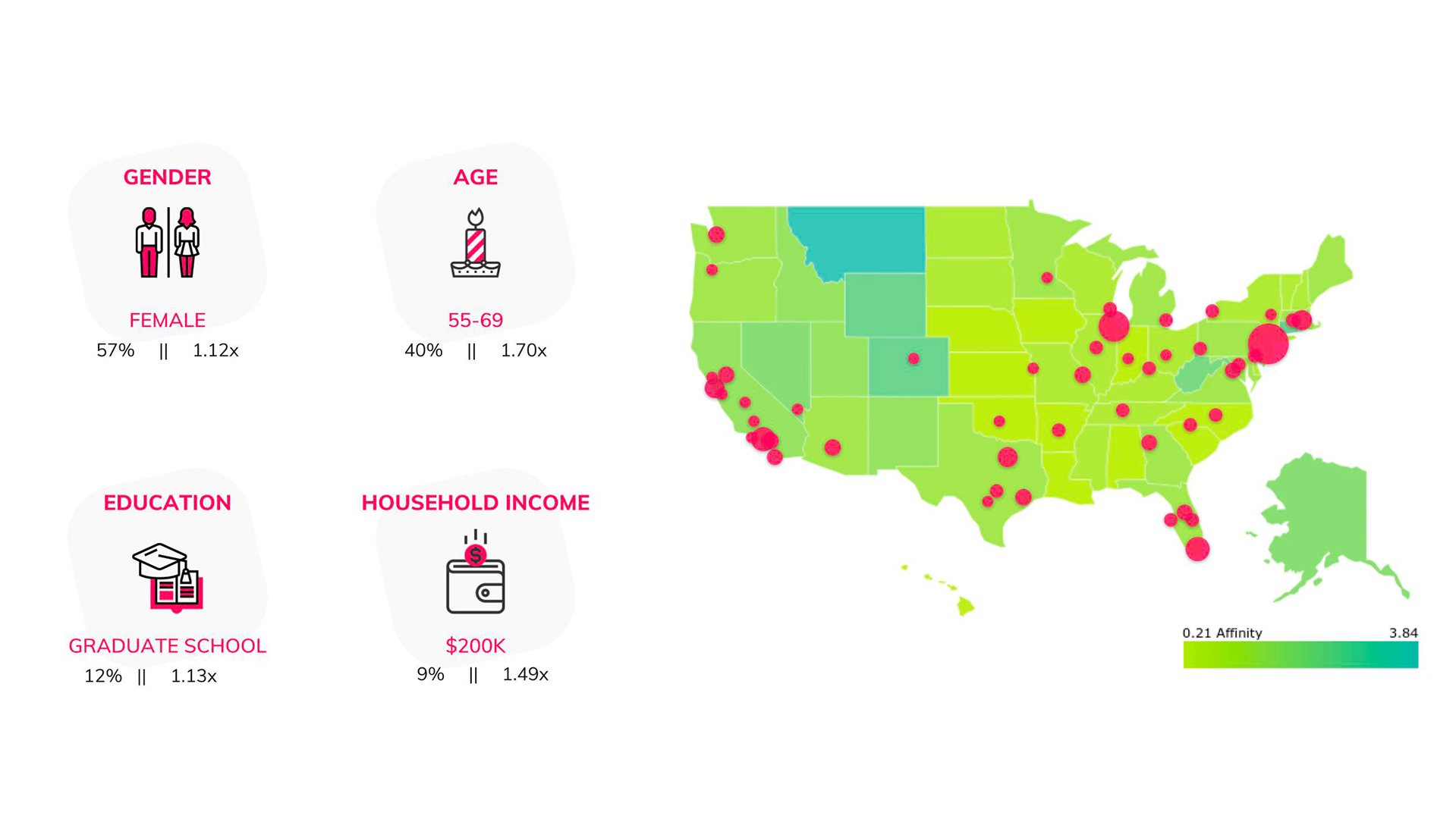

One observation from Hyatt’s audience data is that females are more engaged with the brand, even if males are the majority of business travellers. As more women continue to move into senior management roles, this could prove beneficial for the Hyatt brand, but it will be important for them to ensure their welfare services continue to appeal to their female audience.

Observed consumer interests are expressed as the Affinity Index, which measures how the target audience you are analyzing is different from the average American adult.

-

0<Affinity<1: Audience is less interested in the item than the average American adult

-

Affinity=1: Audience is as interested in the item as the average American adult

-

Affinity>1: Audience is more interested in the item than the average American adult

For specific category interests, health at 2nd highest is a good indication, with Hyatt’s audience 1.4x more likely to be interested than the average U.S. adult. This shows that Hyatt already appealed to health and wellness focused travelers to begin with, or otherwise that their efforts in recent years have paid off quickly.

The relatively lower interest in Beauty, at 1.08x, could also guide Hyatt to make decisions between more full service-salon kind of wellness options versus a stronger relaxation, spa and exfoliation type focus.

Interest levels in specific body care and fitness brands also shows a high interest among Hyatt’s audience for fitness centers and exercise equipment manufacturers, with 4 gyms and 3 manufacturers all having over 5x more interest among this audience than the average U.S. adult.

But can it be that the audiences of hotel brands in general are predisposed to liking fitness and wellness? Or is this unique to Hyatt? We looked at interest in hotels for the audience of fitness and wellness enthusiasts.

(Insert side by side comparison, top 10 hotels: Beauty + Wellness fans (l), Fitness fans (r))

Of the top 10 hotel brands among beauty and wellness fans (left) and fitness fans (right), at least one Hyatt brand appears in the top 7 among larger national hotel chains. This shows that Hyatt does have credibility as a popular brand with those interested in wellness and is within striking distance of becoming #1.

But for Hyatt to truly become the go-to brand for wellness among business travelers, they will need to really tailor their messaging and service offerings to the mindset of high end travelers who like wellness. So we also compared Hyatt’s audience to a general audience for high income Americans who are both interested in travel and are part of the Helixa psychographics segment “Active and Fit”.

Check out this infographic. Enter your Email to see the full Hyatt audience analysis compared against the audience of high income travel lovers who are also in the segment "Active and Fit".