When it comes to brands known for evoking nostalgia that have also managed to transform over time to adapt to cultural and social changes, Mattel and its flagship Barbie are among the best recognized.

With each of Barbie’s transformations, from new career models to diverse races, has come flurries of media attention and consumer buzz, both positive and negative. While other sub-brands like Fisher Price and Hot Wheels are less sensitive to outside forces than Barbie, Mattel continues adapt to changing consumer behaviors for all of their brands.

Mattel’s 2018 website homepage content highlights both Barbie and American Girl career models:

As Mattel also adopts to shifts from brick and mortar to e-commerce and losing Toys R Us, they are revamping messaging and products for a new wave of millennial parents. From their research, it is “evident that parents today were looking for more purpose and more value in their kids' play experiences” said Bruce Rogers from Forbes. President Richard Dickson aims for the right balance to “stay relevant by keeping true to its brand’s past, while ensuring millennial parents are still connecting with the company” Rogers says.

To ensure new products and messaging were designed to assure millennial parents that the brand is aligned with their values and helping their children both learn and aspire, Dickson said “I really studied all of the archives, assets, and founders' perspectives and quotes -- everything was about sparking imagination, transforming young minds through play and driving imagination and creativity.”

But as Mattel re-focuses on millennial parents, what are the similarities and differences between millennial parents’ attitudes and interests compared to Mattel’s existing fans? We took a look at both audiences to see in which ways Mattel may have it easier to connect with both groups, and where they may differ.

Top interests for this group range across Science as well as Games and Toys that focus on educational and recreational products for children. A closer look at specific brand interests shows that Mattel has strong brand presence both as a parent brand and for sub-brands like Barbie, Fisher-Price and Hot Wheels.

High interest in competitors like Hasbro and Lego too show that the toy space is one where a parent or collector might have a favorite brand, but that does not necessarily mean that they do not engage with or own competitor products too. However, the high rank for newly closed Toys “R” Us hurts, as it is likely Mattel will lose opportunistic sales they used to get from customers that only discovered their products while browsing at a Toys “R” Us store.

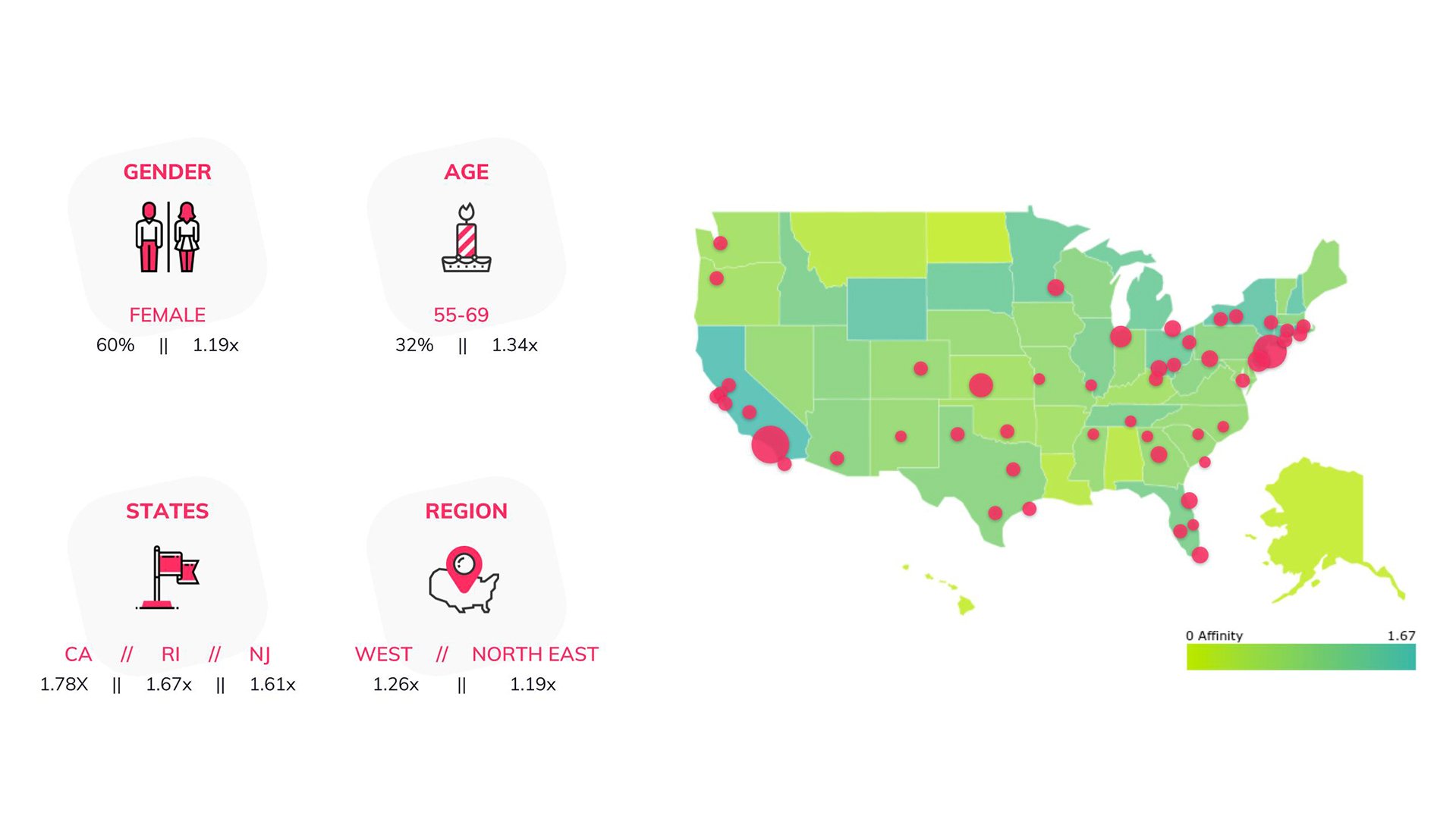

Observed consumer interests are expressed as the Affinity Index, which measures how the target audience you are analyzing is different from the average American adult.

-

0<Affinity<1: Audience is less interested in the item than the average American adult

-

Affinity=1: Audience is as interested in the item as the average American adult

-

Affinity>1: Audience is more interested in the item than the average American adult

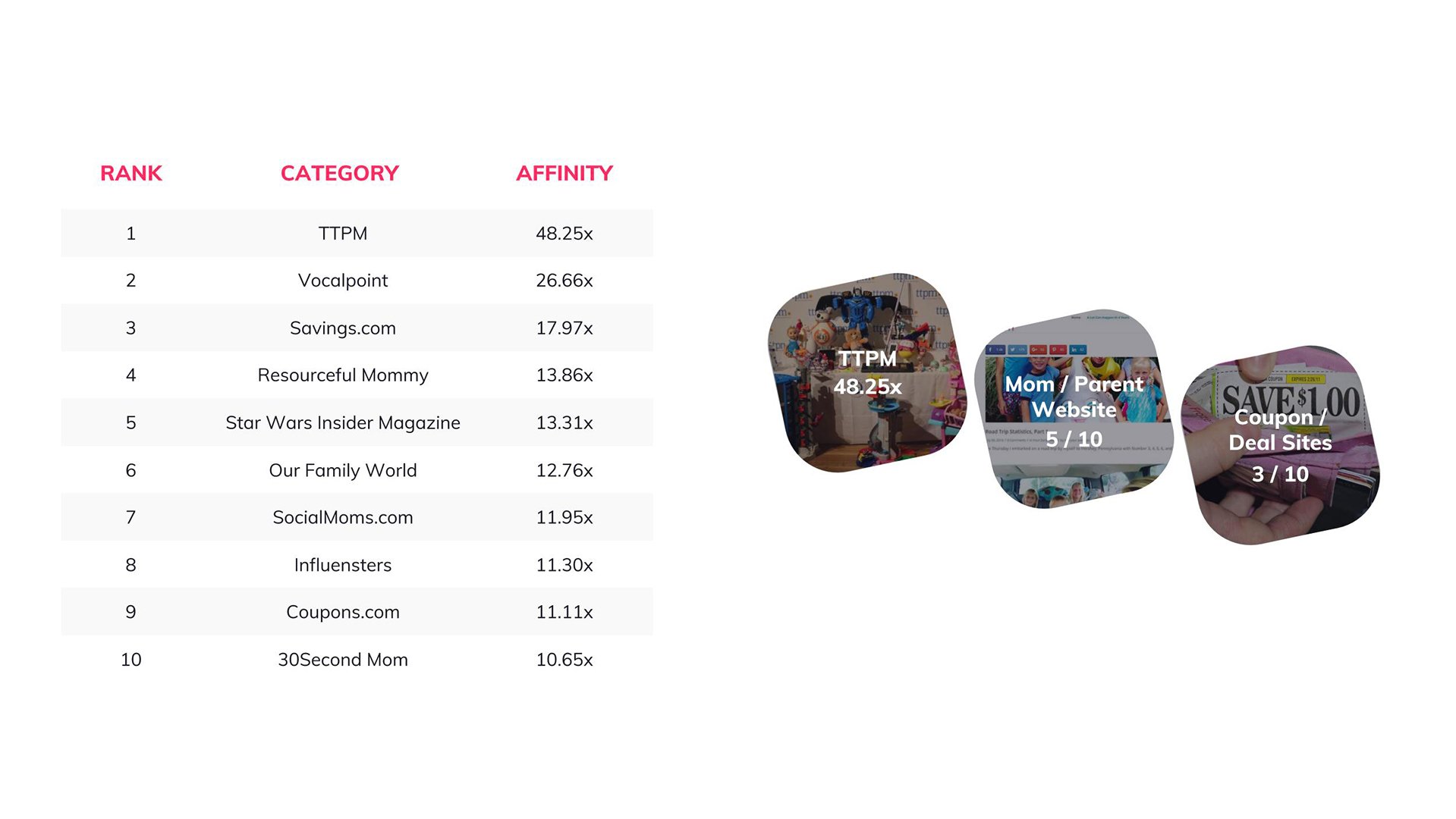

When it comes to the media Mattel’s audience is most interested in, don’t let the older demographic fool you. This audience is web savvy and has very distinct favorite parenting and deal sites tailored to their interests. As a matter of fact, all of their top 10 interests in media are very unique to this group, as they are all over 10 times more interesting to this group than the average American adult. For TTPM specifically, Mattel’s audience is 48 times more likely to be interested in this children’s product review site than the average U.S. adult.

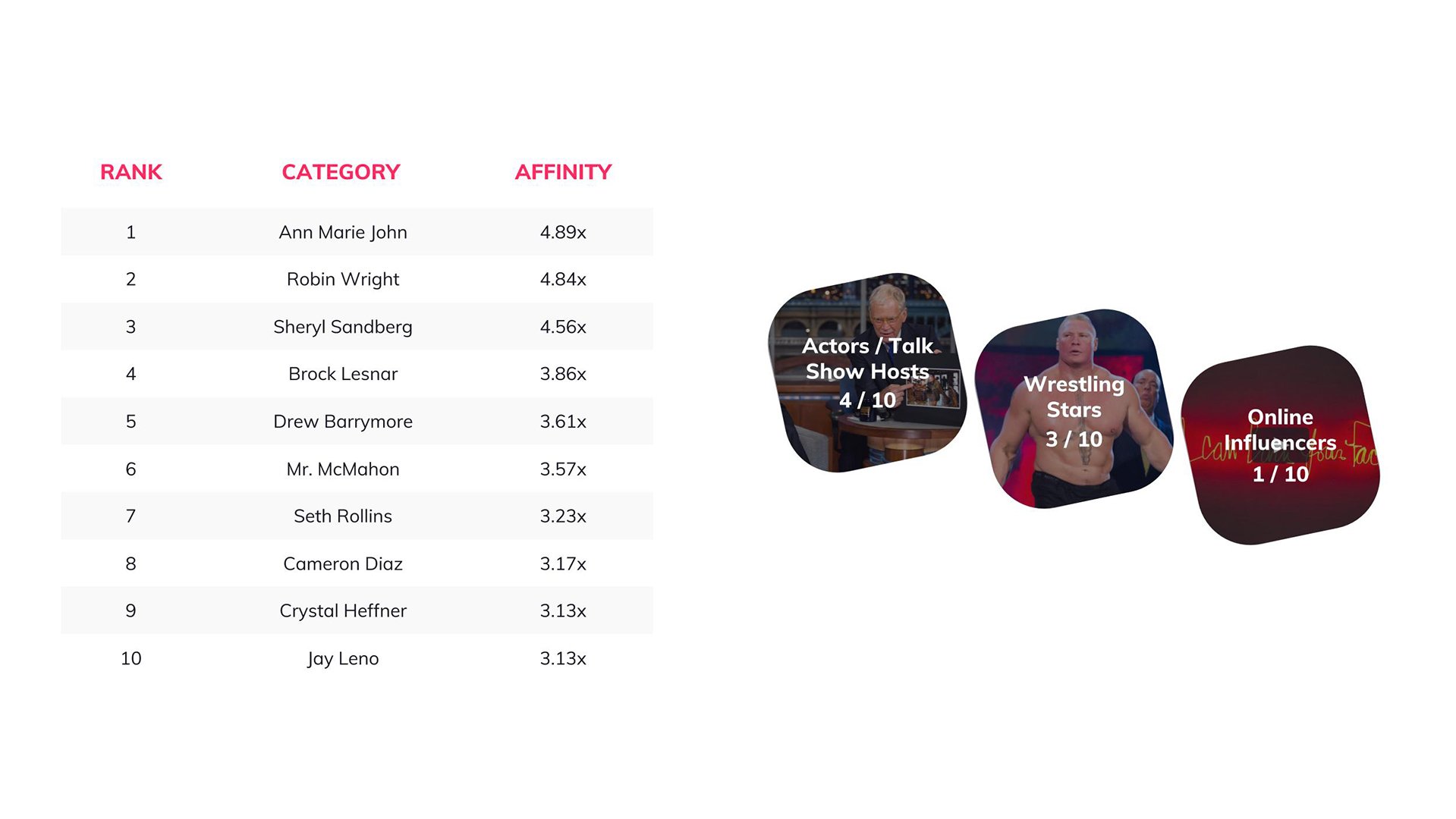

As Mattel looks to the next generation of parents, influencers will likely be the category that changes the most from their current audience to their next wave of target moms. We looked at the top 10 influencers for Mattel’s audience compared to Millennial moms in general, and there is no overlap. Mattel will likely need to maintain separate strategies for their existing audiences and for younger parents based on the disparity in influencer preferences.

For a more detailed look at Mattel’s audience interests check out our Mattel Audience Analysis infographic. Please enter your Email below.