“When you try to appeal to everyone, you end up resonating with no one.”

That quote repeats an old marketing adage we’re all tired of hearing. But, it bears repeating when only 35 percent of marketers conduct annual audience research, according to CoSchedule.

Your audience is made up of complex people who bring a diversity of lived experiences to the table. While it’s not possible to serve every customer a personalized message that accounts for those differences, audience segmentation offers an effective compromise.

By understanding what your best customers have in common, you can reach them more effectively — and find others like them.

Audience segmentation is key to our offering at TelmarHelixa, but we had trouble finding online resources that taught the topic properly. To fix that, I created this guide, which covers everything you need to plan and execute an audience segmentation strategy.

Here’s an overview of what you can expect:

To create more effective segments for your business, download our full Audience Segmentation 101 guide. It includes all of the information in this post, in more detail, plus a full breakdown of TelmarHelixa's Discover segmentation process.

What is audience segmentation?

Audience segmentation is the process of finding strategic subgroups within your target audience, based on shared behaviors, interests, or attributes that indicate how they will respond to marketing. Then, you can tailor your marketing mix to those more manageable subgroups, also called segments.

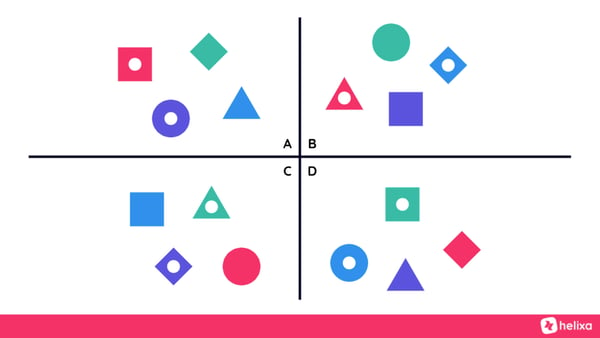

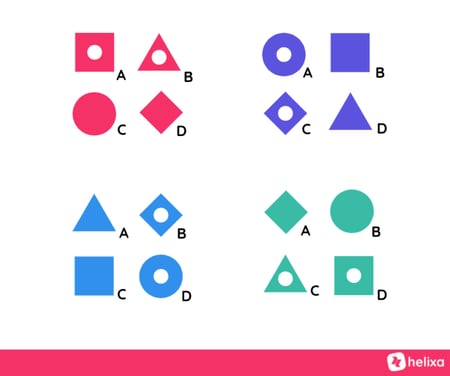

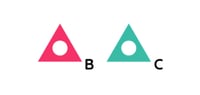

Take this illustration, for example.

You could segment this group of objects by color, shape, quadrant, or the presence of a white dot.

If you were to segment by color, each segment would also represent several quadrants and shapes; those elements aren’t disregarded. But while it’s helpful to understand the differences within a segment, the strategy will be most directly informed by the things they have in common — in this case their shared color.

It’s also becoming easier to create and target segments with multiple things in common. In the above example, we could define one segment as triangles with a white dot, an eighth of the total audience.

Most audiences have countless possible segmentations. Your choices depend on your goals, so let’s take a look at some benefits of audience segmentation.

Audience segmentation is important for choosing who to ignore

Target audience segmentation brings focus to your marketing strategy. You need to understand who you are targeting to understand what they need from you, and the answer is not “everyone.”

This article from Beliyf explains why broad targeting is a trap:

"The reason is simple: when you try to appeal to everyone, you end up resonating with no one. When you try to cover all bases, no potential customer will feel like you understand, appreciate, and can serve their specific needs. Yet when you spend some time thinking about who you’re for (and conveying that on your website and marketing copy), you’ll become immensely appealing to that particular market. And THEN… wonderful things start to happen.”

“When you try to cover all bases, no potential customer will feel like you understand, appreciate, and can serve their specific needs."

Here are a few of those benefits of audience segmentation:

-

- Define your best customers: Often, specific segments of your customer base are responsible for an outsize share of the revenue. For example, 40 percent of Slack’s revenue comes from less than 1 percent of its customer base. By identifying the segments, you can seek out more customers that fit that profile.

-

- Discover new opportunities in the market: The process of defining your best customers can surface opportunities you weren’t expecting. Take Pedialyte, the baby rehydration drink that saw a 60% increase in adult use from 2012 to 2015, as they nursed hangovers. They eventually released a sparkling drink in 2018 to better appeal to that demographic.

-

- Create more specific and relevant messaging: When you market to everyone, messaging gets too vague and ends up becoming completely forgettable. By segmenting your audience, you can understand what each segment needs from you and create messaging that directly addresses the problems they face. For example, Nike is going to speak differently to athletes, people who watch sports, dedicated sneakerheads, and people who wear athletic clothing for comfort.

A strong audience segmentation strategy will get you these results (more on that later) and ensure you are using your marketing resources efficiently. But first, you need to understand the different types of segmentation and when they are most useful.

Types of audience segmentation (with examples)

There is so much to learn about each customer in your audience. To make sense of it all, it helps to understand how each attribute fits into the bigger picture and helps you communicate more effectively.

At TelmarHelixa, we use a simple framework with three types of audience segmentation techniques:

-

- Demographics focus on who your customers are

-

- Psychographics focus on how your customers think

-

- Behaviors focus on how your customers decide to buy

Any attribute in these three categories can be used to slice and dice the entire audience if your data set is robust enough. But choosing the best one for the job depends on your goal and audience.

Let’s dive into the three types.

Demographic segmentation — who are your customers?

Demographics are the most traditional parameter for audience segmentation. They are easily captured using multiple-choice survey questions and (usually) split into distinct segments.

Here are some common demographics:

-

- Gender

- Age (and generation)

- Race and ethnicity

- Relationship status

- Household income (HHI)

- Employment status and occupation

- Education level

- Presence of children

- Language

- Geographic location

- County type (rural, urban, suburban)

Some researchers separate geographical segmentation as a fourth category, but we feel it fits best under demographics. That’s also where you’ll find geographic attributes in TelmarHelixa's Discover.

Additional resources:

-

- Hurree: The Pros and Cons of Demographic Segmentation

- HubSpot: The 14 Best Demographic Questions to Use in Surveys

- Versta Research: How to Ask Race & Ethnicity on a Survey

Psychographic segmentation — how do your customers think?

Psychographic segmentation (also called attitudinal segmentation) helps you get inside your customers’ heads. Not only do psychographics inform a customer’s purchase decisions, but they also tell that person’s story and provide the foundation for meaningful messaging.

Traditionally, psychographics were divided into activities, interests, and opinions (earning the name AIOs).

I prefer Adele Revella’s approach at the Buyer Persona Institute, where she breaks psychographics down into five main categories:

-

- Personalities: “Describes the collection of traits that someone consistently exhibits over time, as commonly assessed through a 5-Factor Model,” also known as the OCEAN model

-

- Lifestyles: “The collection of someone’s day-to-day activities: their associations, where they live, where they spend their time, etc.”

-

- Interests: “Include hobbies, pastimes, media consumption habits, and what occupies someone’s time” (I would also include influencers here)

-

- Opinions, attitudes, and beliefs: These are “distinct psychographic categories, but I’ve grouped them together because they tend to be strongly correlated”

-

- Values: “Describe their sense of right and wrong”

All five categories inform the way your customers perceive your product, but not every insight will be relevant. If you sell paper towels, it’s much more helpful to know they cook often and care about sustainability than it is to know that they have a gambling habit.

Psychographics are my favorite of the three segmentation types; they paint your audience in full color. And the process is getting faster every year, thanks to audience intelligence platforms that allow you to understand what your audience is engaging with online.

Additional resources:

Behavioral segmentation — how do your customers decide to buy?

Behavioral segmentation is the most actionable type. It’s directly tied to the way your customers are thinking about (and interacting with) your product and marketing.

It can be difficult to capture some of these signals accurately, but the rise of analytics software and machine learning has made it much, much easier. With the right software, we have data on everything from the first impression to the conversion and sale, and we can turn that activity into meaningful behavior patterns.

Here are some possible behavioral segmentation parameters for your customers:

-

- Point of discovery: How did they find your company and product? If one channel or source is sending you an outsize number of customers, prioritize it.

-

- Purchasing behavior: What behavior led up to the purchase? It’s important to consider the different buyer journeys your customers go through before deciding to buy.

-

- Purchase frequency: How often do they buy from you? Loyal customers are more valuable but also factor in the amount of each purchase.

-

- Purchase timing: When do they buy from you? This is important to understand so that you reach them at the proper time, and it allows you to factor in seasonality and special occasions like Black Friday.

-

- Level of engagement: How engaged are the customers with your communications? This is more easily segmented with modern digital communication tools and CRMs.

-

- Product usage: How often does your customer use your product or service? This is much easier to determine if you sell apps or a SaaS product with built-in tracking, but you can also determine this for physical products with survey research.

-

- Product benefits: Your product offers more than one benefit; which one is primarily motivating them to buy? This is one of the most important behavioral segmentations you can do, and it should impact positioning and messaging.

-

- Stage of awareness: Are they aware of your product and the way it solves their problems? In Breakthrough Advertising, Eugene Schwartz identified five stages of awareness: Unaware, Problem Aware, Solution Aware, Product Aware, and Most Aware.

All of these segments can be important in determining how to segment and speak to your customers, but I would personally prioritize product benefits and stages of awareness. With only those two elements, you can understand your customers’ "jobs to be done" and carry them through the consumer decision journey.

Additional resources:

-

- McKinsey: The consumer decision journey

- Harvard Business Review: Know Your Customers’ “Jobs to Be Done”

- WordStream: Features vs. Benefits: Here's the Difference & Why It Matters

- Melissa Bolton: The 5 Stages of Buyer Awareness

Choosing a type of segmentation

Behavioral and psychographic traits are more helpful in understanding the “how” and “why” behind your audience’s purchases. That intent is far more valuable than demographic data.

That doesn’t mean demographics are useless. Demographics can be helpful for understanding who will (and won’t) buy your product, especially when they serve as signals for psychographic and behavioral traits.

For example, if you’re selling high-end furniture, you may only target high earners. But they are buying the furniture because they have a love of design or a desire to demonstrate their status — not just because they have the money.

By understanding what each type of segmentation can provide, you’ll be better equipped to make decisions between them throughout the audience segmentation process.

Building an audience segmentation strategy

So while we’ve established earlier that not enough marketers are conducting proper audience research, CoSchedule also found that the ones who do are 303 percent more likely to achieve their marketing goals.

Many marketers are simply too overwhelmed to start. And I get it, the process can seem out of reach, especially if you’re a small department (or team of one). But the sooner you get started, the more time you have for trial and error.

The research required for segmentation doesn’t need to be extremely comprehensive and unwieldy. Often, keeping it simple and asking the right questions is enough to make a difference.

Here are five actionable steps with tips for getting started:

- Gather and analyze existing data

- Conduct new audience research

- Identify the segments

- Review and vet the segments

- Develop audience profiles

1. Gather and analyze existing data

Before you conduct any original research, start with an audit of all the available data and findings.

An internal review can help you discover your best customers and learn more about them. Then, look outward to find similar people and understand more about why they buy.

Here are some other common internal sources:

-

- Existing customer info and research

- Transaction data

- Revenue data

- Notes from sales calls

- Customer feedback and reviews

- Engagement data from your CRM (and product, if applicable)

- Website analytics

Stay close to the money; that revenue and transaction data is going to be key for discovering the most profitable segments of your audience. The data can often surface opportunities you weren’t aware of, so leave your preconceived notions at the door.

Next, an external look can provide either a bird’s eye view of the market or a look into the motivations and grievances of a specific person, depending on the source.

Here are some external sources to consider:

-

- Message boards and forums

- Syndicated research and industry reports

- Publicly available datasets

- Social media

- Amazon reviews for similar products

You may also want to consider using an audience intelligence platform like Discover and Explore, which can provide deep insight into your audience using existing data sources. This type of platform is an investment, but it can drastically reduce the amount of time it takes to conduct this type of audience analysis and deliver actionable results

Once you have collected data from the relevant sources, compile it into a central location and see what insights you can glean. Look for findings that surprise you and pay special attention to patterns and trends that could be the basis for segmentation.

Then, it’s time to start filling in the gaps with original research.

Additional resources:

-

- Digital Marketing Institute: 8 Ways to Extract Value from Customer Data

- McKinsey: Capturing value from your customer data

- SurveyMonkey: 6 Deep Audience Research Methods to Improve Your Targeting

2. Conduct new audience research

Secondary research is valuable but limited. Existing internal sources may not provide the specific answers you need, and external sources are not specific to your unique audience.

That’s why it’s often a launching pad for primary research, which solves both problems and provides a deeper, richer view of your audience.

There are many ways to conduct audience research for segmentation, categorized into two main types:

- Quantitative research can be measured and quantified. This type of research benefits categorization, so it more easily lends itself to segmentation.

-

- Qualitative research is descriptive and helps answer questions that focus on the “why.” While it may seem less relevant for segmentation, it is critical for understanding your customers’ problems and motivations.

SOURCE: Optimal Workshop

It would be difficult to get into all the different types here, so I’ll focus on the most important approach in each category.

Survey research (quantitative)

-

- Purpose: Categorize your audience in a number of different ways and understanding the size of each category

- Best for: Demographic and behavioral segmentation

- Pros: Quick results, scales well, offers distinct categorization, more representative, results can be easily segmented

- Cons: Survey questions and answers can be interpreted differently, survey fatigue can cause drop-offs or missed questions, no way to elaborate or clarify

Customer interviews (qualitative)

-

- Purpose: Collect in-depth insight into the buyer’s problems, motivations, and opinions

-

- Best for: Psychographic and behavioral segmentation

-

- Pros: Answers the “why,” allows for clarifying follow-up questions, visibility of non-verbal cues, more focused attention, elaboration can lead to unexpected findings

-

- Cons: Expensive and time-consuming, limited sample, can be intimidating, sometimes hard to get customers on the phone

Both types of primary research have pros and cons, but they complement one another nicely and provide a more holistic view of your audience when implemented together. The more comprehensive that view is, the easier it will be to define your segments.

Additional resources:

-

- Jen Havice: Finding the Right Message

- Customer Camp: 23 Ways to do Audience Research (and Better Understand Your Customers)

- Qualaroo: The Marketer’s Guide to Surveying Users

- CrazyEgg: How To Do Customer Interviews That Reveal Priceless Insights

- ActiveCampaign: 15 Money-Making Market Research Questions to Ask Your Audience

3. Identify the segments

Your analysis of the research in step two can range from simple to extremely complex. Where you land on that spectrum depends on your survey design, software, level of understanding, and the amount of time you’re willing to spend. You can learn more through the additional resources below.

For now, here’s what I would consider a minimum viable analysis:

-

- Take a first pass: Check out the results of each question and look for things that are interesting or surprising to you. Make a note of any insights that you find.

-

- Segment the results through cross-tabulation: Considering those results and everything else you know about your audience, start segmenting the dataset through cross-tabulation. You want to focus on the segments that are most likely to yield important insights. For example, a B2B company might segment the results by occupation or level of seniority, whereas a bicycle company might be interested in segmenting by how often they cycle. Your first cross-tab report may not provide all the answers, so keep at it and try segmenting the responses in a variety of ways.

-

- Draw your conclusions: At this step, you need to start sifting through your findings and understanding the broader implications of the data. This is an art, not a science, but your research and analysis should be telling a story about the best segments for your business.

-

- Record your segments: Define and document the segments you have chosen including all the relevant details.

In Discover, this step becomes much easier. You can run your audience (or any audience you want to analyze, based on your research) through our segmentation tool to let machine learning handle the heavy lifting. You can also build custom segments and quickly explore them.

If the segments feel right, move on to step four. It can be tempting to keep trying new segments and cross-tabs, but at some point, you have to just stress-test your best segmentation and see if it holds up.

Additional resources:

4. Review the segments

Once you have your segments defined, you want to review them and make sure you’re on the right track.

First, make sure all of the segments are distinct. Within each segment, the people should be similar in relevant ways. And between segments, there should be limited overlap in those same attributes.

Then, run each one through a five-step checklist taken from this Builtvisible article.

They list five attributes of strong segments, with explanations:

-

- Measurable – This means you can determine its size and composition and you will also be able to make intelligent predictions about the revenue and profit it can generate.

-

- Substantial – This refers to profitability, not size. A segment might constitute only one customer, but if the profit is significant it may well be viable.

-

- Differentiable – Different segments will react differently to the same marketing mix. If they don’t, they are not different segments.

-

- Actionable – You should be able to provide the value that this customer seeks. For example, a low-cost airline has little to offer the intercontinental business traveler.

-

- Accessible – You should be able to reach the segment at an appropriate time and place and in the right context.

It can be tempting to skip this review step, but it’s necessary for an effective audience segmentation strategy. Trust me, you don’t want to wait until you’re reporting on your brand new campaign to find out a segment is nonviable.

5. Develop audience profiles

Once you have identified your segments, you need to build out audience profiles, or personas, to tell the story of each segment. This is where your audience segmentation comes to life.

In Finding the Right Message, Jennifer Havice writes:

“The problem with most personas is that they have been put together with either irrelevant data or no data at all. Many personas are built around a profile of what the business would like its ideal buyer to be instead of representing the buyer’s expectations, needs, wants, and concerns.”

To avoid these pitfalls, you need to be ruthless in deciding whether each data-driven insight is relevant to the segment in question — and the overall consumer journey. It will vary between products and industries: For B2B software, you’ll want to include the buyer’s job title and level of seniority; not so much if you’re selling toothpaste.

But despite those differences, strong personas share many things in common:

-

- They are specific. Segments are generic, but a persona tells the story of a specific customer profile.

-

- They are human. Give the persona a name, a picture, and a short bio that provides some backstory. This makes them feel real — and memorable, so the whole organization can adopt them more easily.

-

- They highlight goals and roadblocks. Your customers buy your product to solve a problem or become a better version of themselves. The persona needs to highlight the nuance of their motivations, and the obstacles holding them back.

-

- They provide context. To communicate effectively, it helps to understand their personality, their interests, and their sources of information and influence.

-

- They are unbiased. Personas reflect your insights and research, even when it’s inconvenient to your current positioning and materials.

To get the full value out of audience segmentation, you need to get your findings off of the page and into the field, so you can understand what works and what doesn’t. Then apply it to the next round of research, and the one after that.

Ultimately you don’t need data that collects dust in the marketing folder. Effective personas are actionable tools that you’ll return to again and again.

Additional resources:

-

- Buffer: The Complete, Actionable Guide to Marketing Personas

- CleverTap: How to Create a User Persona

- Buyer Persona Institute: 5 Rings of Buying Insight for Buyer Personas

- Alexa: Here Are 10 Buyer Persona Examples to Help You Create Your Own

A better way to segment your audience

It’s possible to take a scrappier approach to audience segmentation, but the tools you have access to will greatly impact your ability to collect and process your data.

Here are some common audience segmentation tools:

-

- Google Analytics: Google Analytics (you may have heard of it) is a web-based tool that allows you to research and segment your audience using basic parameters like demographics, on-site behavior, and how they found your website.

-

- Survey tools: Survey tools allow you to conduct the necessary audience segmentation research and analyze the results.

-

- All-in-one CRM tools: The most robust customer relationship management (CRM) tools can track a variety of ways that customers and prospects engage with your marketing. You can record these interactions and use them to segment your communications.

-

- Audience intelligence platforms: Research platforms like Discover can provide a 360-degree view of your audience (or any audience) in minutes. You can move quickly and discover insights you would’ve never known to look for. A tool like Helixa is especially useful if you have a portfolio of products or a roster of clients that all need their own analyses.

Going through this entire process manually will provide insights that aren’t possible through other means, but there is a simpler, faster way to segment your audience.

TelmarHelixa uses machine learning to segment your company’s audience — or any audience you can build in our platform — taking the guesswork and labor out of the process.

Our technology parses up to several thousand data points per segmentation to identify distinct and effective segments that you can then explore at a deep level of granularity.

If you want to maintain control of the process, or if you want to explore segments you’ve already identified, you can build out custom audiences in the platform to analyze and compare.

We can identify their demographics, lifestyles and personalities, favorite influencers, top interests, and even consumption data through a partnership with MRI-Simmons — all in minutes.

If you’re ready to understand what your audience really cares about and connect in more meaningful ways, schedule a 15-minute call to learn more.

The sum of the parts is greater than the whole

Marketers have some catching up to do in the audience research arena. While it can be intimidating, we strongly believe that a robust audience segmentation strategy is not only a step in the right direction, but also a game-changer for your business.

It’s impossible to fully understand your entire audience without first understanding the distinct groups it holds. Audience segmentation bridges that gap and illuminates who they are, how they think, and how they buy. By understanding when to use each of these attributes (and how to discover them) you can move forward confidently with your audience segmentation strategy.

That knowledge will focus your marketing efforts, empowering you to reach your best customers and find your next prospects.

To create more effective segments for your business, download our full Audience Segmentation 101 guide. It includes all of the information in this post, in more detail, plus a full breakdown of TelmarHelixa's segmentation process.