Some of us, more than others, felt the closure of gyms over the past few months.

Whether it was your regular stop on the way to or from work or just the sort of membership you bought on the 2nd of January and used a total of five times the remainder of the year, the loss of the workout environment required some sort of mental adjustment.

The UK’s allocated fitness hour

As someone who does not frequent any sort of gym, they weren’t at the forefront of my mind when Boris Johnson put on his big-boy pants and told us to close everything down (the loss of the pub and sports sort of drowned that out).

However, as we were sternly told to all stay in our homes (unless we couldn’t, or shouldn’t, or something), we were given two outlets: our weekly “essentials” shop outing, and our single allotted hour of daily exercise.

The parks filled with more people than I’d ever seen before doing actual workouts, and as I walked past them all (sipping on my “exercise beer”) week after week, I began to wonder: will the gym ever return?

Granted I’m biased, but truth be told why would anyone shell out for a membership to a sweaty institution with public showers and loud grunting when they could just… go outside?

If habits are developed over time, and we’ve had three to four months of this, exercising at home could become the norm moving forward — and it may very well stay that way.

The critical question (what is this, market research?): does the data back all this up?

To back off on my slightly-too-personal critique of gym culture, the gym provides a lot of people with a lot of value (I have been to one before). But what we’re seeing now is a transition of the appeal to digital fitness, thus diluting the gym’s power to drive memberships moving forward.

A gym has exercise classes and personal trainers. This gap has been filled by YouTube tutorials, FitBits, native-OS health apps, and other paid apps covering everything from female-centric Blogilates to competitive Strava.

With the ability to design and track your own workouts tailored to your own goals and current capabilities, the need to be judged by another human for how out of shape you are has gone entirely out the window.

A gym also has equipment. That’s a bit of a tough one, as not many people have the free space at home to fill it with massive machines they plan to use – at the very, very most – once a day. And they’re expensive.

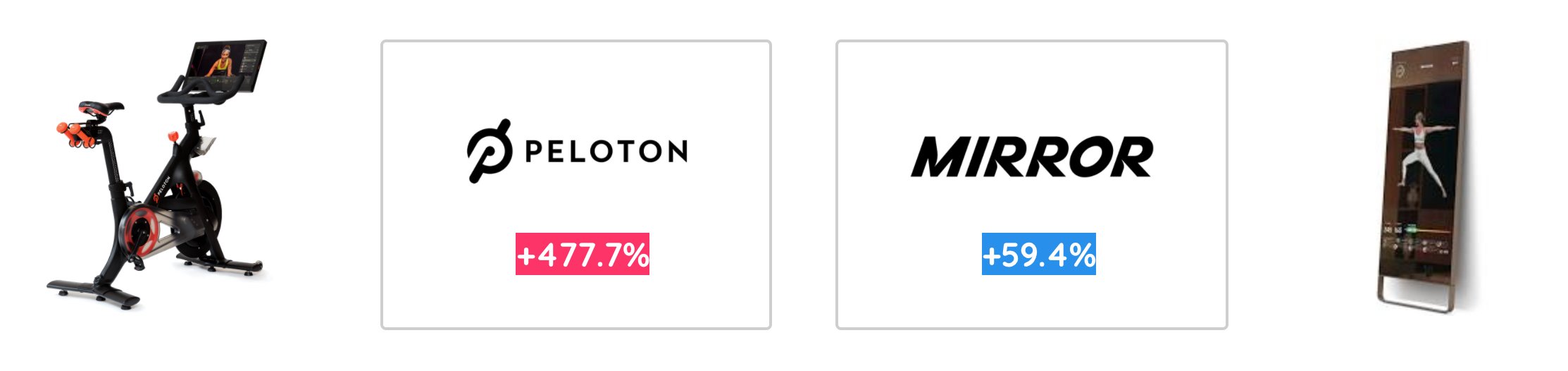

However, online engagement with Peloton – which is now integrated with Roku TV and offers either the app or the upgrade to the bike itself – has seen a 477.7% leap since lockdown. That’s nothing to scoff at.

And Mirror, which advertises itself as “It’s a cardio class, it's a yoga studio, it's a boxing ring, it's your new personal trainer, and it's so much more” (it’s an interactive mirror with thousands of training videos) has seen a 59.4% boost in interest online since lockdown.

What we’re looking at is actually a transition that is far more futuristic than my park wanderings necessarily indicated. The movement to everything-digital has been slow up until now, but relentless, and the workout is its latest convert.

Though it was likely already on the product road map, the lockdown has accelerated this direction of innovation through necessity and convenience.

The FitBit and MyFitnessPal audiences in Helixa are primarily Netizens and “on the web for purpose” (at 11.46 and 11.76 affinity, respectively) – as well as, evidently, upper-tier home-oriented with money to spare, given that the post-lockdown affinity for Dyson is at a whopping 19.78 – and 43.9% of them are 18-29 years old.

The future of fitness is heavily online

This, in and of itself, isn’t surprising. However, I’m curious to see the reactions and evolutions of the businesses catering to this audience.

LuluLemon purchased the increasingly successful Mirror in June, and despite only launching in 2018, Mirror looks set to reach $100 million in 2020 revenue.

Are athletic apparel companies going to expand their lifestyle branding beyond sneakers and yoga pants into selling home fitness itself?

As much of the workforce continues to conduct business largely from home, fitting a trip to the gym into the daily routine looks to be something that won’t happen for many in the near future. Especially now, when workouts can be done in very welcome half-hour breaks from the kitchen office. And as more consumers invest in home workout equipment and apps, the budget for fitness will largely be filled already by the time lockdown lifts. New habits will have been acquired that fit into new schedules.

Athletic brands and apps are surging in to fill this new schedule, and gyms will have quite a workout ahead if they want to catch up.

Skye Davidson is our UK Analyst, checking in from across the pond to bring us her perspective on business happenings, consumer trends, and whether cookies are actually “biscuits.”